crypto tax calculator nz

Mining cryptoassets such as block rewards and. CryptoTraderTax takes away the pain of preparing your bitcoin and crypto taxes in a few easy steps.

Crypto Tax Calculator Review June 2022 Finder Com

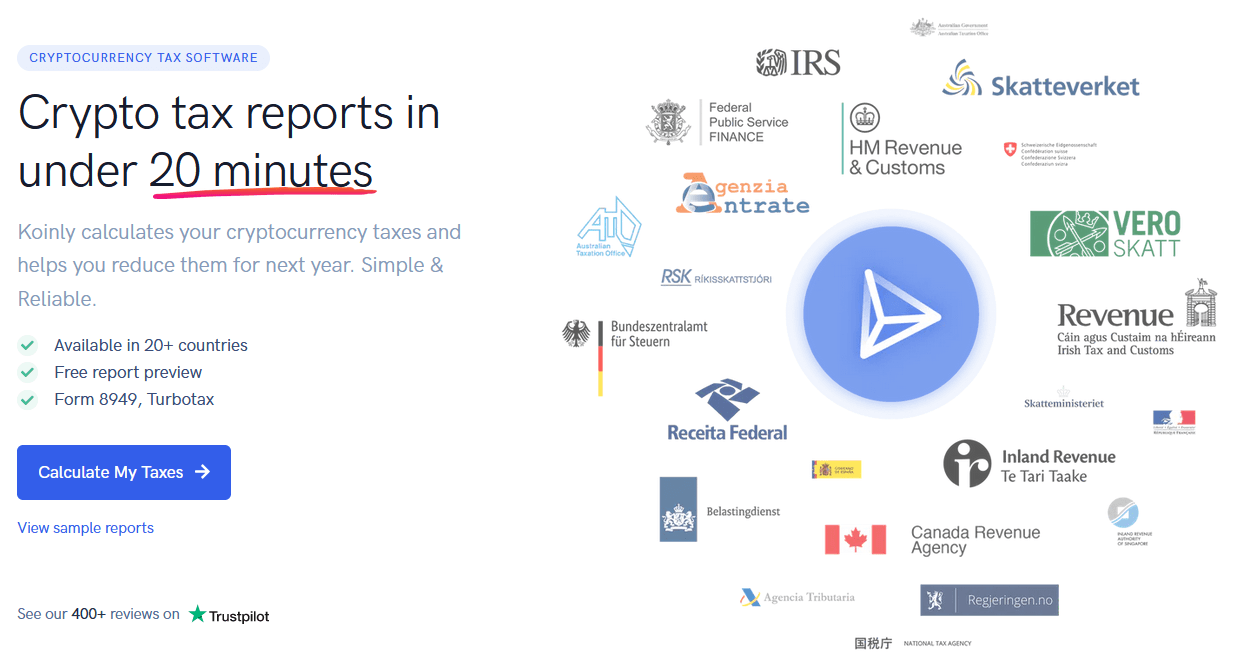

Filing your crypto taxes in New Zealand Koinly helps New Zealanders calculate their income from crypto trading mining etc.

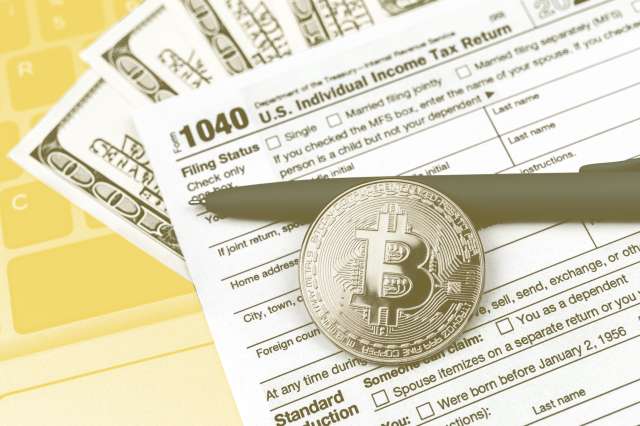

. Income from cryptoassets is subject to New Zealand tax only if the income has a source in New Zealand. CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. Check out our free and comprehensive guide to crypto taxes.

0325 5000. First-in first-out FIFO This valuation method presumes. The second and third situation raises a key question of what is the source of income.

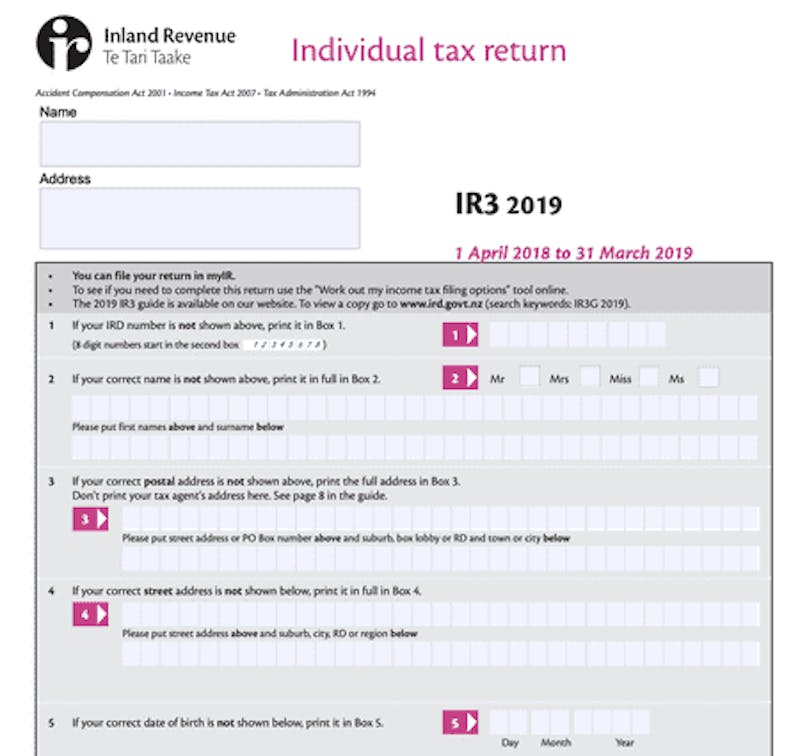

Enter the price for which you. The IRD has now published guidance to explain how New Zealands existing tax laws should be applied to bitcoin and other cryptocurrencies. To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status.

Taxoshi NZs Crypto Tax Caluclator. This income could be. Its important to note that this is just a.

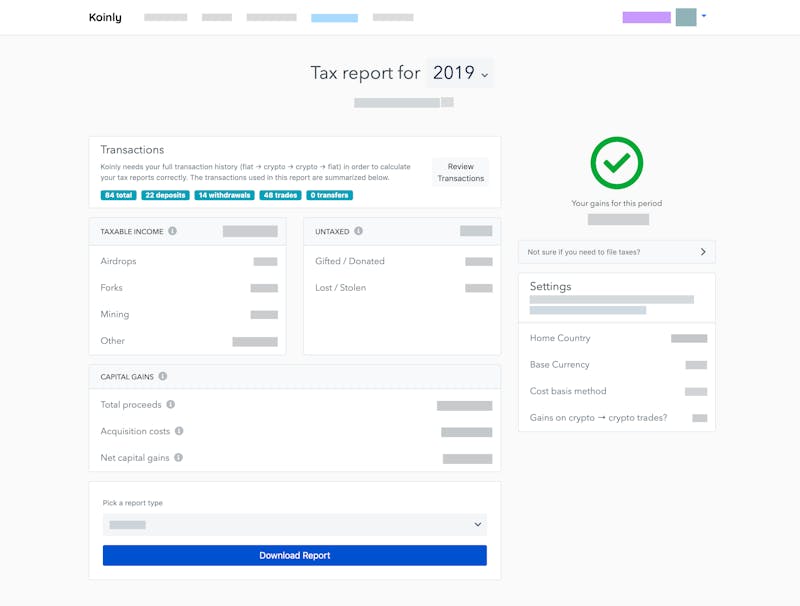

Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of. Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a. Crypto Tax Calculator Plans Pricing Generate reports for all financial years under just the one 365-day subscription.

The Inland Revenue service makes it clear that. As crypto asset taxes work just like any regular taxes in New Zealand you can use your myIR account to manage and track your taxes. 14000 is taxed at.

Rookie 49 billed yearly Get started For users who dabble in the crypto. Best crypto tax software for New Zealand Find the right crypto tax software to help do your crypto taxes in New Zealand. Divide the initial investment amount.

1 Add data from hundreds of sources Directly upload your transaction history via CSV or API. An individual earning 20000 of income per year pays total tax of 2520 or an equivalent tax rate of 126. Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax.

Some cryptoasset transactions may. Start by connecting your exchanges and importing your historical transactions. This means you would need to calculate your profits on the income you received from cryptoassets.

Take the initial investment amount lets assume it is 1000. This information is current. Buying crypto is not a taxable event see example 2 below.

Calculating the New Zealand dollar value of cryptoassets You need to use amounts in New Zealand dollars NZD when filing your income tax return. Done 1 supported exchange done Custom Data imports done Up to 100 trades close No mining. Heres an example of how to calculate the cost basis of your cryptocurrency.

The tax amount is calculated as follows. Download your tax documents. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

To work out your crypto tax obligations the IRD suggests that you can use either of these methods to work out a value. Exchanges Blockchain Blockchain Main Wallets Supported Main Wallets. When you exchange the BTC for ETH disposal of the BTC happens and you need to calculate the price difference of the BTC in NZD between when you bought it with NZD and.

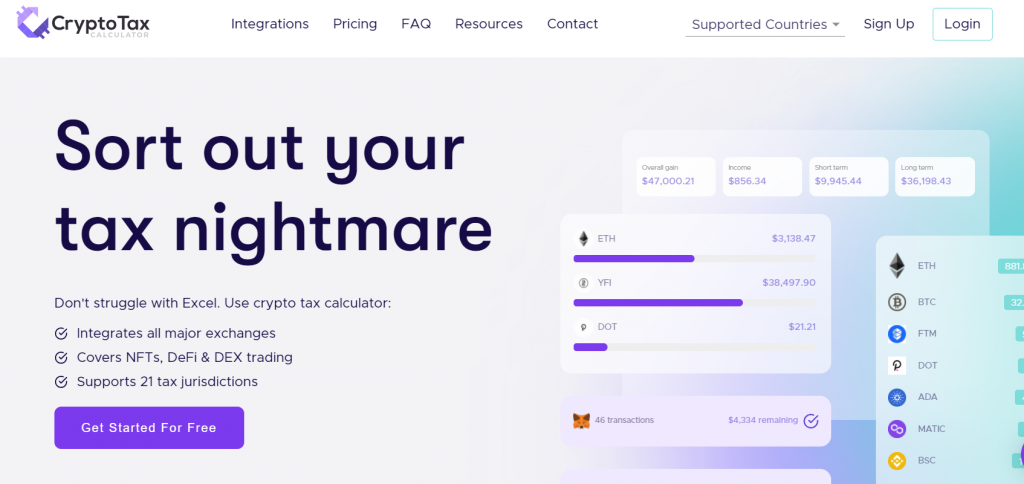

Whether you are filing yourself using a tax software like TurboTax or working with an accountant. 99 per tax year If you only do a small amount of trading Starter Reports are all you need. Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years.

Koinly can generate the right crypto tax reports for you.

Cryptotaxcalculator Cryptotaxhq Twitter

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money

How To Calculate Cost Basis In Crypto Bitcoin Koinly

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Black Sunday For Crypto As Bitcoin And Others Plunge Bitcoin Plunge Worst Day

Cryptocurrency Taxes What To Know For 2021 Money

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

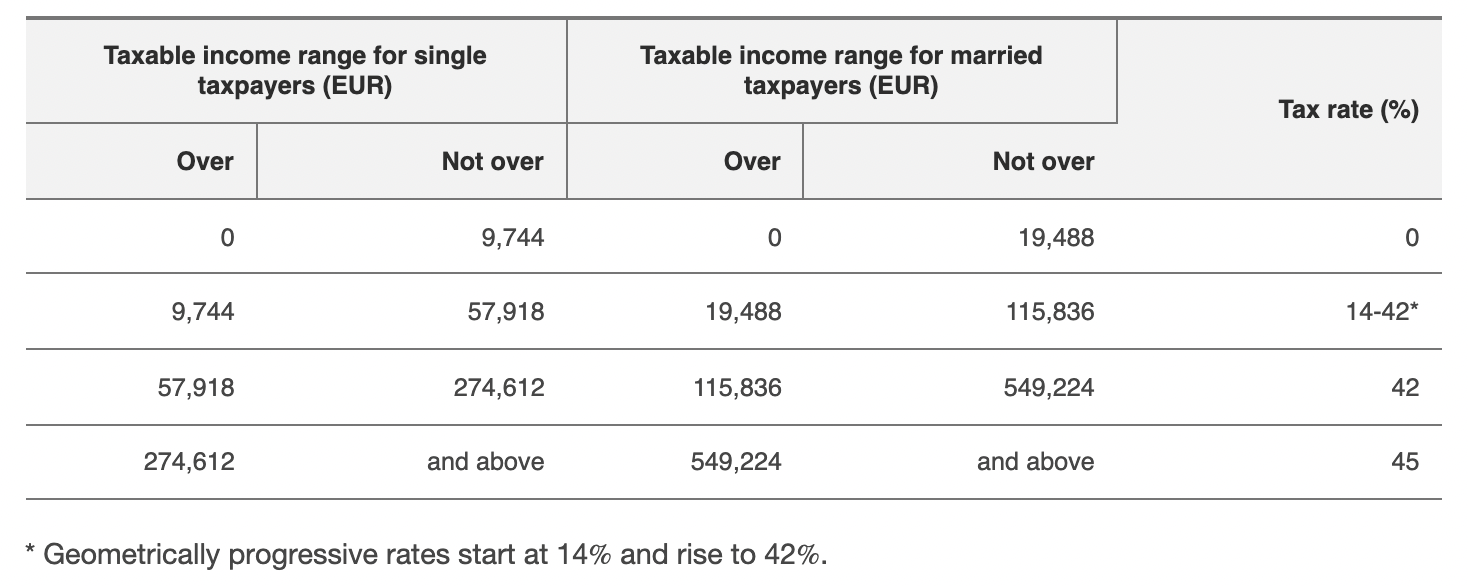

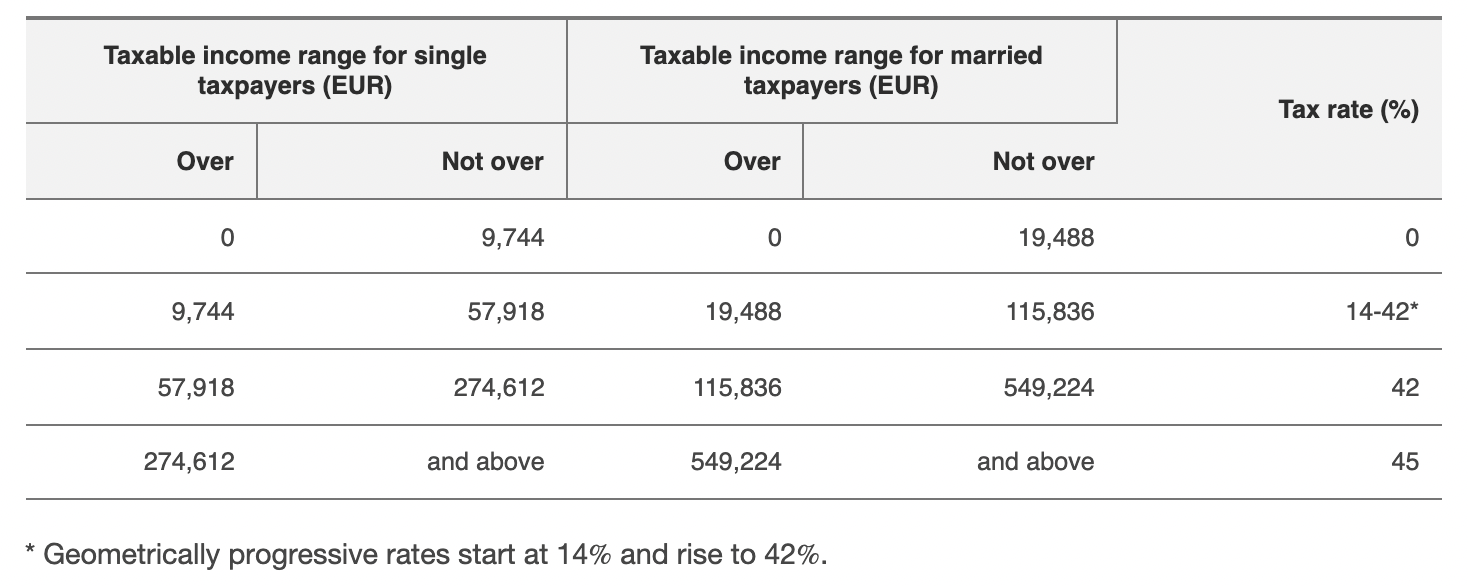

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

Crypto Tax Calculator Review June 2022 Finder Com

5 Best Crypto Tax Software Accounting Calculators 2022

Capital Gains Tax Calculator Ey Us

3 Steps To Calculate Binance Taxes 2022 Updated

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Taxoshi Get Your Crypto Tax Under Control